A peek onto the balance sheet of most small businesses, shows a good many are financed by other sources, something many can relate to is a business American Express card (a specialty finance company that provides working capital to businesses).

A peek onto the balance sheet of most small businesses, shows a good many are financed by other sources, something many can relate to is a business American Express card (a specialty finance company that provides working capital to businesses).

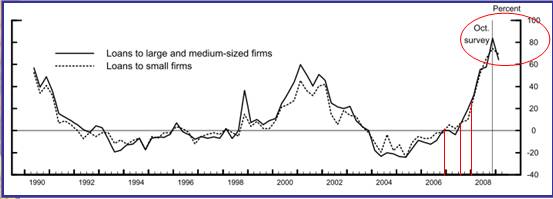

Now more than ever, banks are saying “NO” to new credit requests. A survey by the Federal Reserve Board clearly shows lenders reluctance to lend reached a 20 year high toward the end of 2008.

Source: Federal Reserve Board “The January 2009 Senior Loan Officer Opinion Survey on Bank Lending Practices”

And contributing to the credit freeze may companies are experiencing is the dramatic number of banks that have failed and aren’t lending at all today. There have been more bank failures in the first half of ’09 than in any preceding individual year in recent history!

So, what’s a business owner to do? The good news is there are still alternative sources of capital available for most every business purpose: growth, business expansion, turnaround, merger & acquisition.

The issue is “how do you find it?”

Enter the commercial loan intermediary. A good commercial loan intermediary can quickly size up the facts of the request and the company and assess how viable the request will be competing in the capital markets.

A good commercial loan intermediary understands all types of business financing (working capital, equipment, real estate, cash flow and hard equity). They will have a lot of experience in the field and a depth of contacts in the capital markets in all types of financings.

Of course, the business owner can spend countless hours on the internet, at the library, calling the yellow pages, filling out applications and be no farther along after a month than after one meeting with a good intermediary.

An intermediary with integrity will say “no” if they don’t think your project is viable to place, and they will not take any money from you until they have presented a few general options for you to consider.

Their job will be to quickly determine the facts surrounding your credit needs and then match them to their database of sources, and facilitate the process through to funding.

Expect to pay a bit more for capital if you can’t get it at the bank, because many of the specialty lenders are rich guys who borrow at the bank and re-lend to you. So they have to ‘mark up” the bank’s cost of funds to cover their profit. An analogy is a ‘cosigner fee”. The finance company is, in effect, co-signing your bank loan and charging you fee to do it!

Expect to pay your intermediary, after all, they are your advocate and lifeline, and you never know….you may need them again.