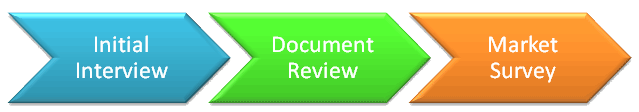

Generally, the initial interview (utilizing Assessment Questionnaire) lasts about an hour with all principals of your business. Then we assess the facts and synthesize them into the review to determine what options are viable and what are not. This is followed by testing the capital markets with likely lenders from our exclusive list of proprietary sources. You will find that our's is a very hands-on approach combined with discipline and leveraging of our years relationship and knowledge.

As the market survey results with suitable matching of sources with your businesses needs, Corporate Funding is now dedicatedly engaged to place the financing. We work aggressively in preparing customized packages for specific sources and towards its submittal. Next we coordinate the review and due diligence of your transaction with you and the sources.

As our proprietary financing sources come back with offers and proposals it is critical to note that many lenders are putting firm expiration dates on offers. We are seeing the market changing so rapidly that these offers are seldom renewed. And when they are, they will be at less favorable terms. The funding process involves legal and final due diligence and requires much coordination. Corporate Funding helps drive this process, resulting in successful funding and completion of the project.